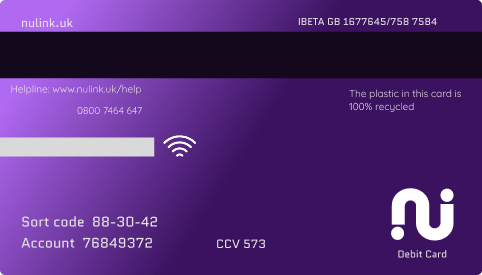

Some cards are only available on subscription plans. Fees may apply.

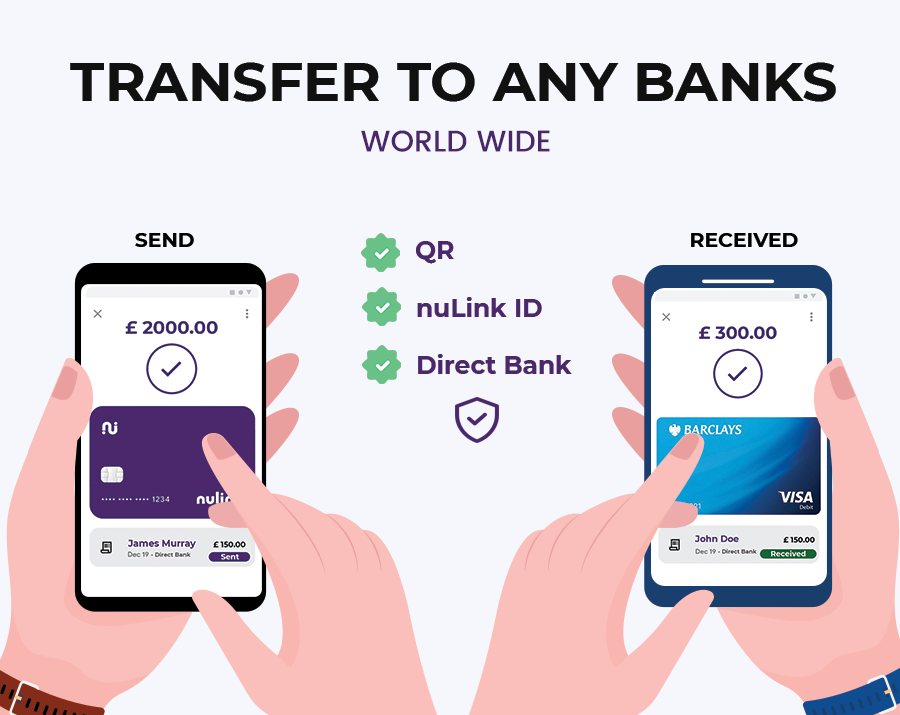

Join millions customer worldwide and save on global transfers with Nulink. Send money quickly in 70+ currencies to 160+ countries.

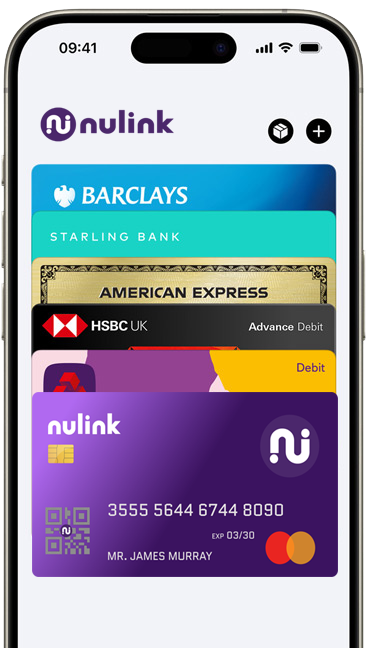

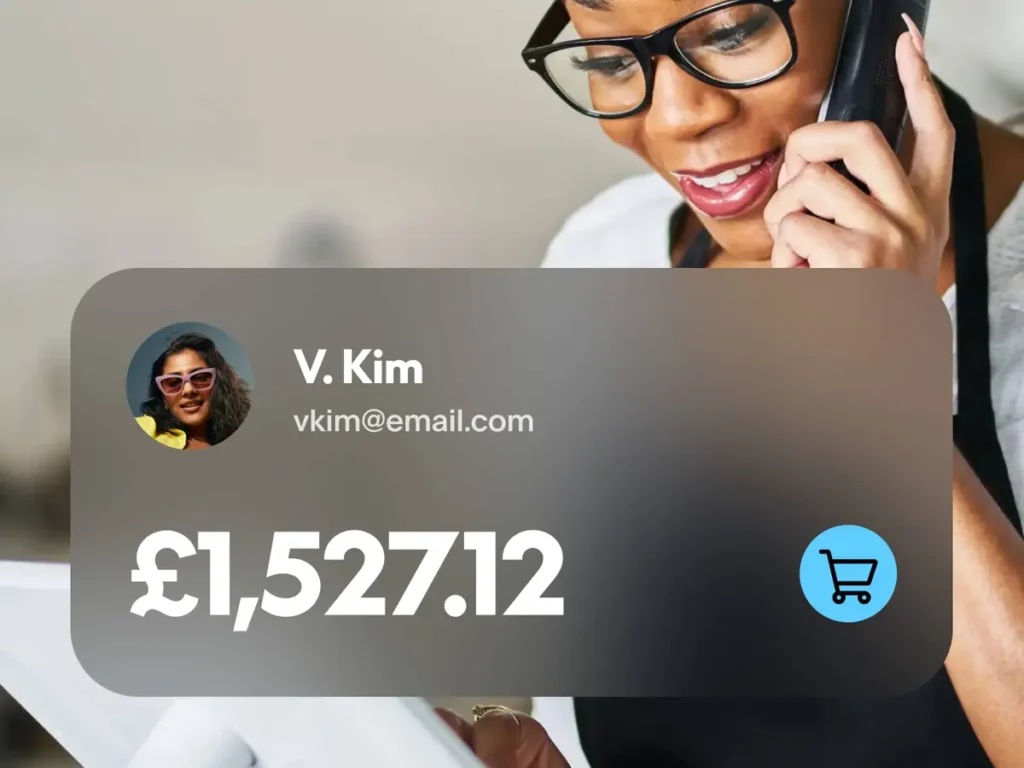

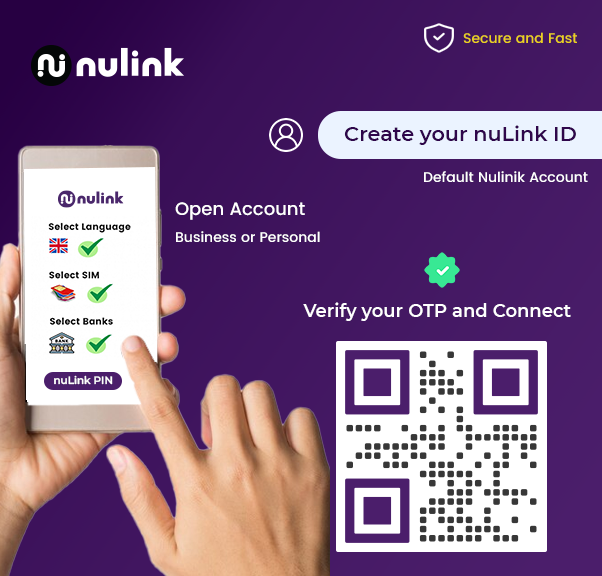

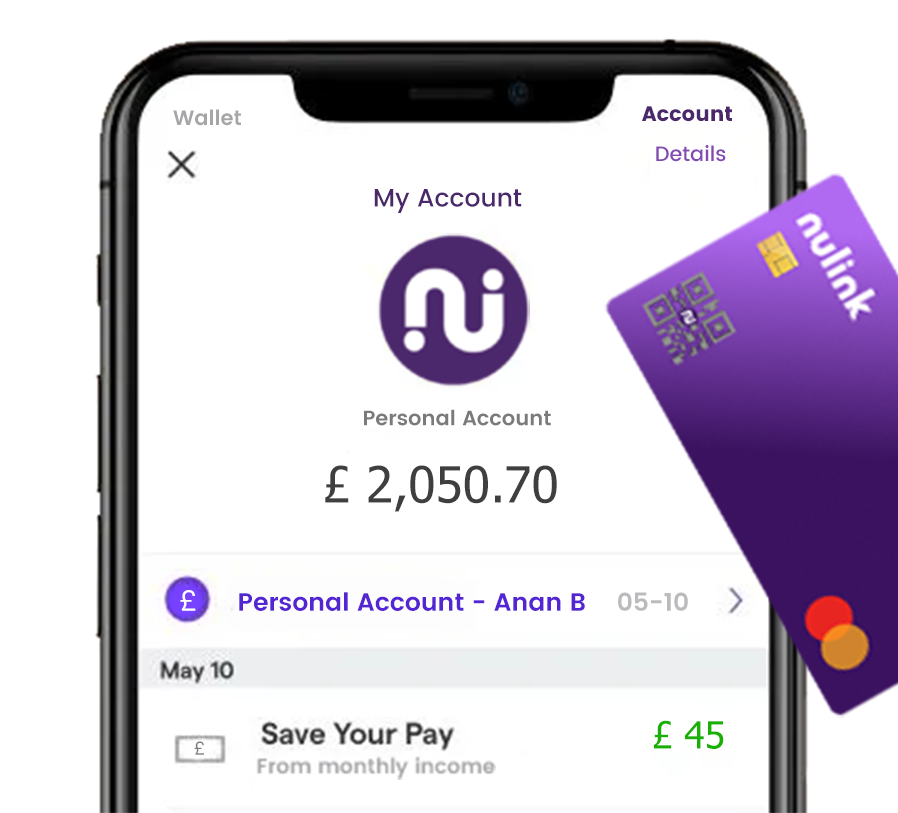

The app lives right on your iPhone & Android. It’s where you securely keep your default Nulink card, credit and debit cards, boarding passes, tickets, car keys and more — all in one with eWallet features place. And it all works with iPhone and Android phones, so you can take less with you but always bring more.

Join millions customer worldwide and save on global transfers with Nulink. Send money quickly in 70+ currencies to 160+ countries.

From Apple to Tesla, Amazon to Nvidia, Meta to Google become a part owner of the brands you know and love. Choose from over 5,000+ stocks in-app.

Capital at risk. Fees may apply.

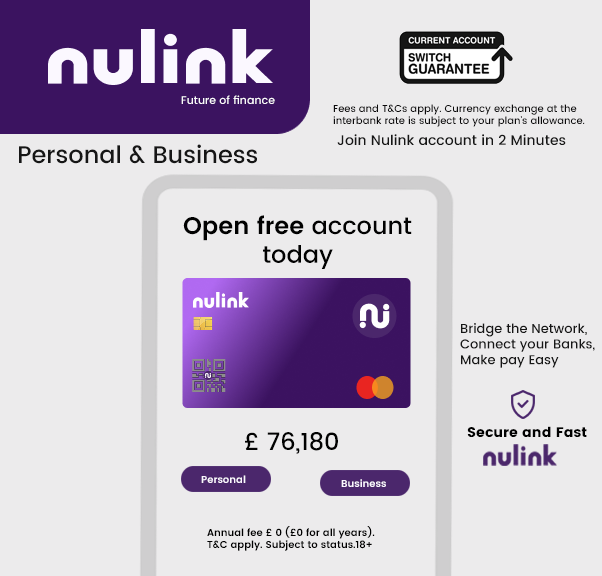

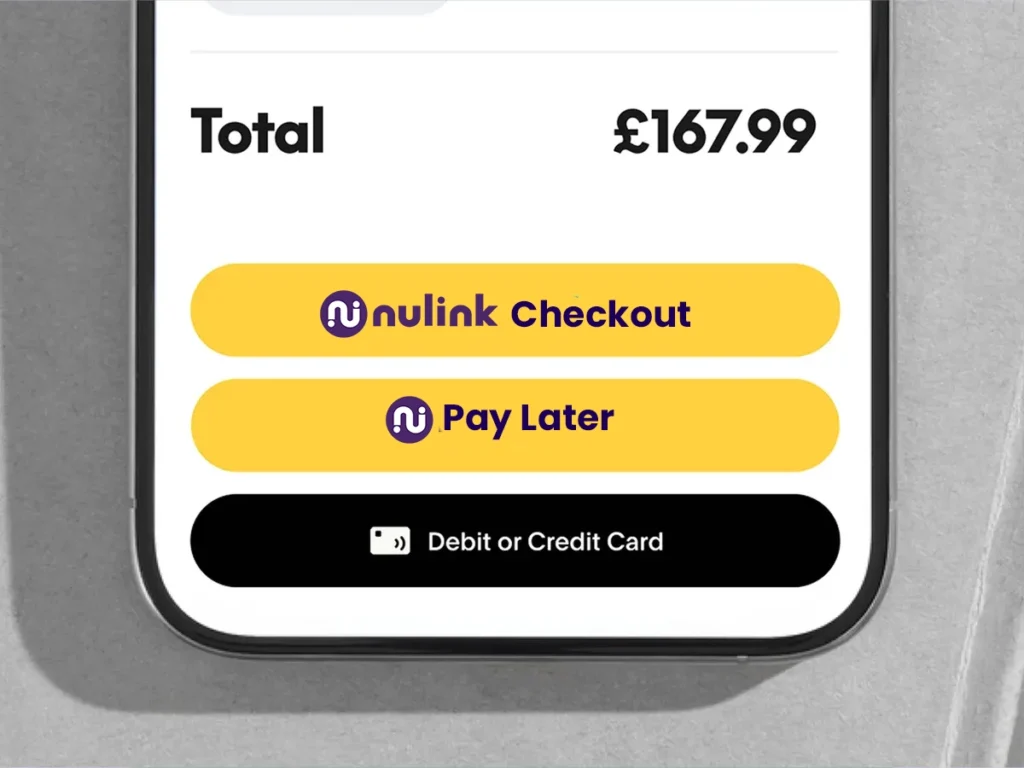

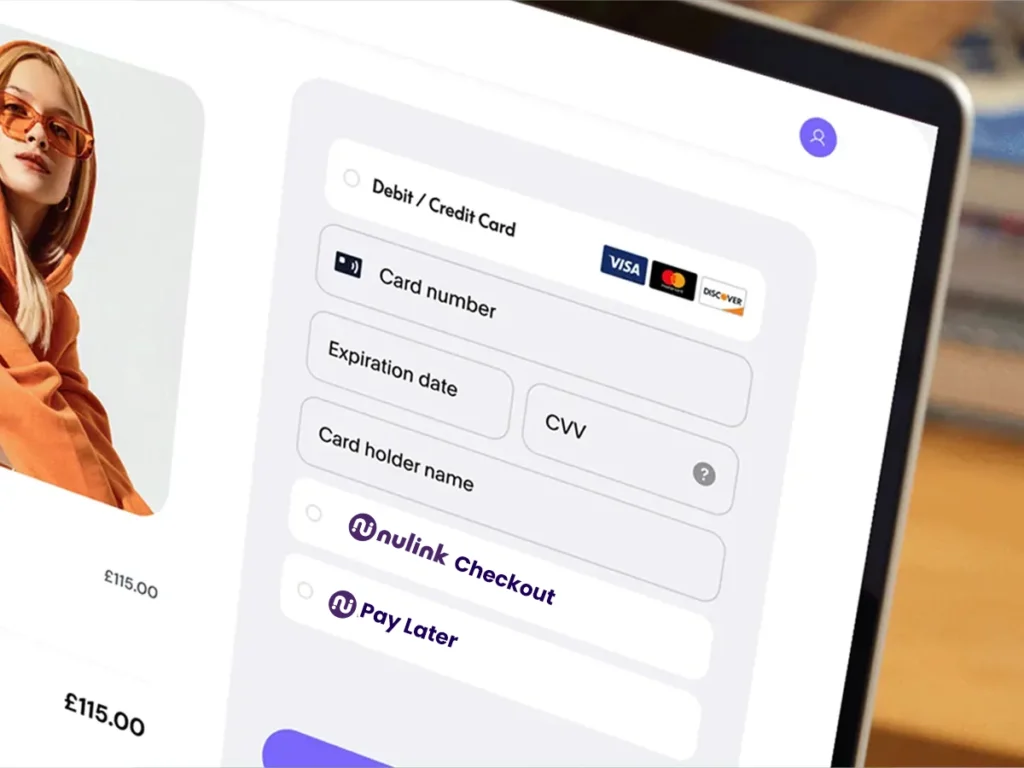

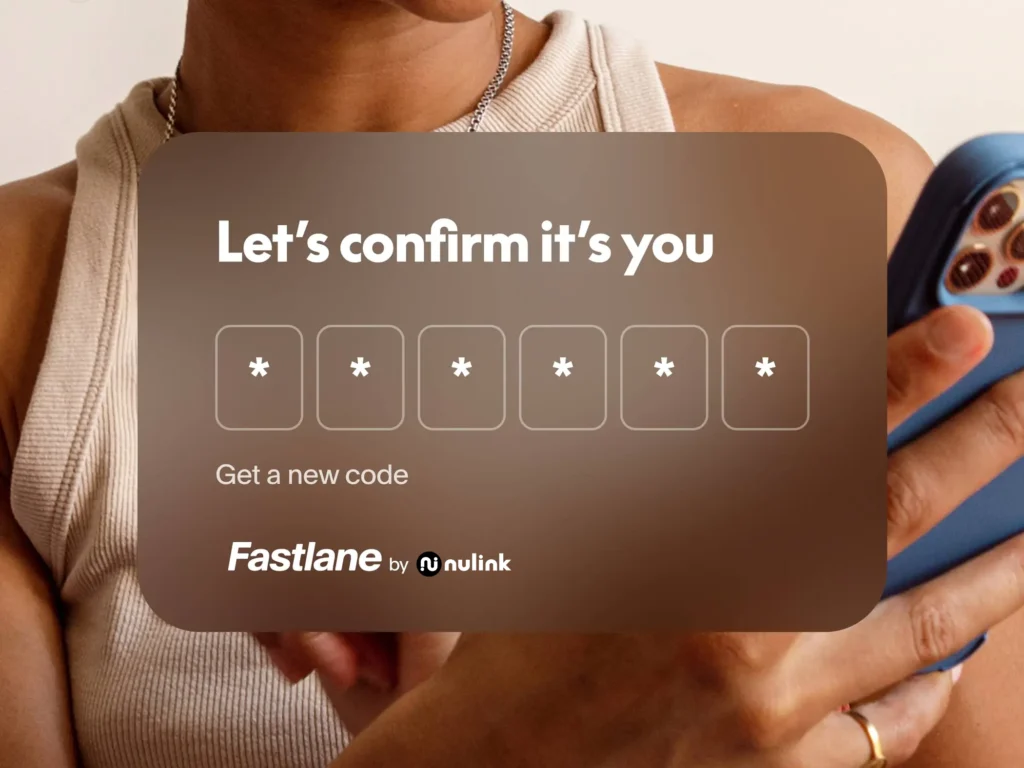

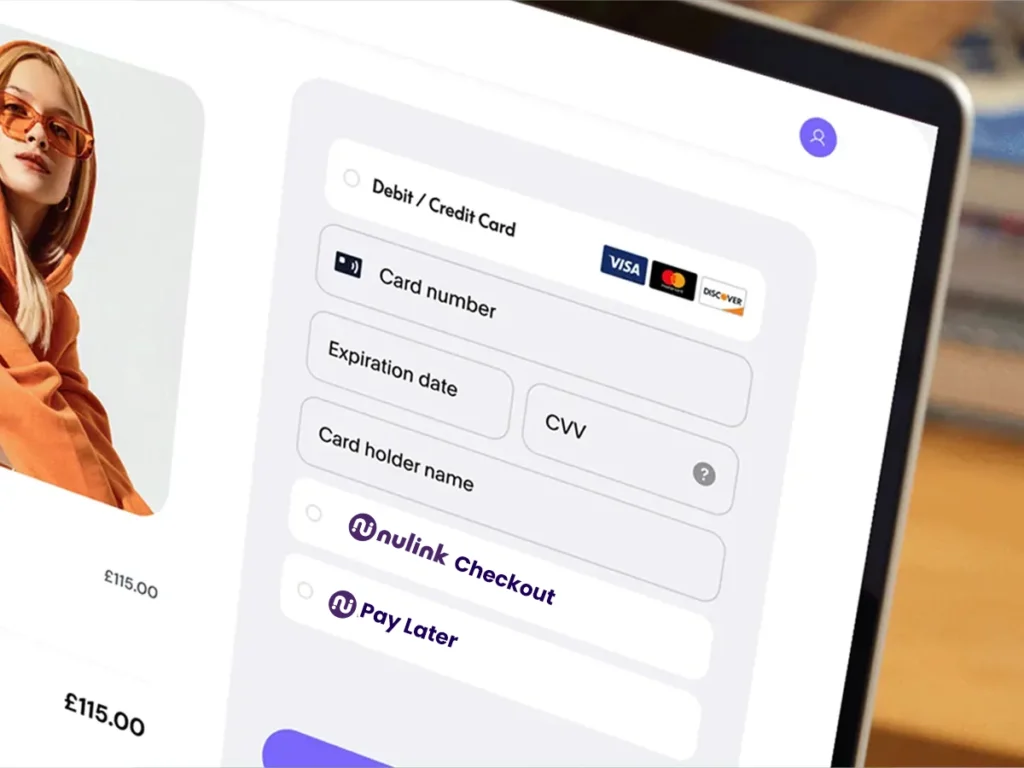

NuLink is a next-generation unified payment system in the UK, built to make digital transactions simple, secure, and efficient. With its advanced eWallet features, users can link multiple bank accounts in a single mobile app, giving them the flexibility to manage payments, receive funds, send international transfers, store loyalty cards, and even use QR UPI to pay anyone directly from their bank account. This all-in-one solution eliminates the need for multiple apps, making financial management seamless and user-friendly.

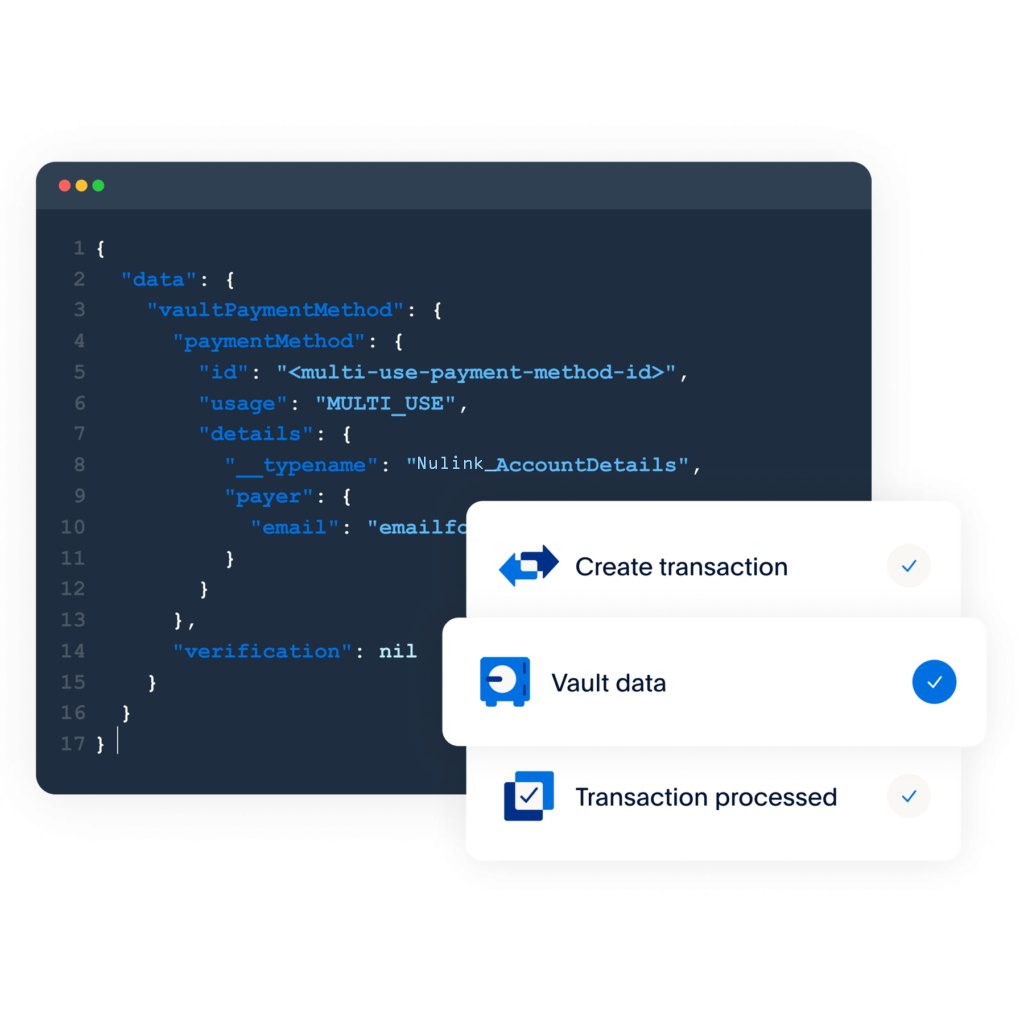

For businesses, NuLink provides a free Business API that ensures smooth integration across platforms. The NuLink API offers developers a comprehensive set of web services that allow them to embed NuLink’s powerful payment solutions directly into their applications. This enables companies to accept online payments, manage financial transactions, and streamline day-to-day operations with ease, ensuring global reach and reliability.

Beyond online transactions, NuLink also supports merchants with point-of-sale (POS) services across the UK, offering some of the best rates in the market. By combining online and offline payment solutions, NuLink empowers businesses of all sizes to handle financial operations more effectively while giving customers a fast, secure, and convenient payment experience.